For someone entering the equity markets; the NIFTY 50 is the bellweather index to invest in. Thats because it consists of blue chip large caps comprising India's largest stocks.

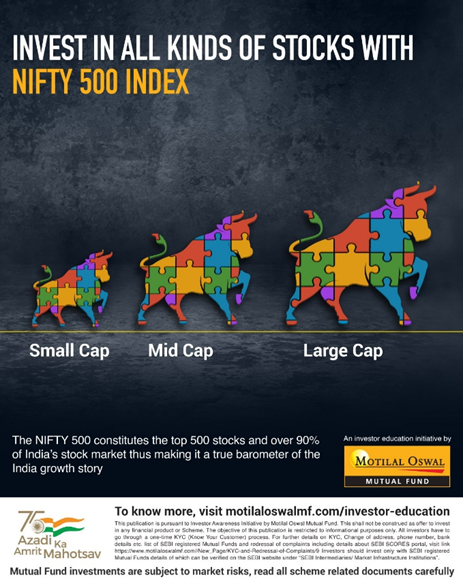

However; there is another index which is the true Bharat Ka Index. An index that captures the true essence of the Indian stock market with over 90% of its market cap covered( vs 51% of the NIFTY), an index that comprises all 21 sectors ( NIFTY 50 covers only 14) and combines all the stocks of Nifty 50 Index, Nifty Next 50 Index, Nifty Midcap 150 Index, and Nifty Small Cap 250 Index. Globally too indexes like the S&P 500, S&P China 500, Stoxx Europe 500 are a bellweather of the stock market. And what's more ; the NIFTY 500 has outperformed the NIFTY 50 in terms of returns ( 15.6 vs 14.1% CAGR or 36x vs 26x ) as well as lesser volatility ( see details here)

So if you want to participate in the growth story of the Indian stock markets but don't know what stocks to buy but still want to invest; you should look beyond the NIFTY 50 and invest in the NIFTY 500. What's more there exist cost effective Index Funds that help you do this efficiantly

This is the focus of an investor education campaign by Motilal Oswal Mutual Fund. As an equity investing expert, MOAMC 's investor education efforts too go beyond generic messaging on SIPs etc to more specific messaging on how investors can make the most of the stock markets.

The creative idea has been to use the metaphor of another bellweather of the stock markets - the bull.

Have a look at the campaign below which is a combination of TV, print , digital and on ground messaging.

Campaign conceptualised by The Sweet Spot and executed inhouse by the MOAMC Marketing team

TV

PRINT AD