Tuesday, February 18, 2025

'Consumerise' institutional research reports. Enter the Heroverse

Thursday, September 26, 2024

WE DIDN'T START THE F.I.R.E

THE MORE THINGS CHANGE; THE MORE THEY REMAIN THE SAME

Thursday, August 29, 2024

CONTEXT. CONTENT. CELEBRITY....... and COMMUNICATION

If advertising can seamlessly be seen as content it makes the brand message powerful. And if this is done in the correct context using the right celebrity; then sone pe suhaaga

Ganesh Grains is a well known brand for atta, maida, suji , besan etc in the West Bengal market. However when it comes to spices; it is a challenger taking on the well entrenched competition like ITC( Sunrise), Catch, Tata etc

It's campaign for spices hence needed to punch above it's weight.

This started from the brand strategy. There are two main criterion for selection of spices( masala's) - freshness & purity. Ganesh decided to focus on the 'purity' proposition as it had a propreitery colour sorter technology that helps sift out the differentiate pure vs impure/imperfect whole spices at the grinding stage itself so that you get the purest spices.

Hence the functional proposition of colour sorter technology for purest spices

But how do we make this proposition contextual content?

Don't you sift a good apple/mango from a bad one based on its colour? Don't you see the colour of a rose to figure whether it is fit for gifting or not? Sure ; fragrance too matters; but your first level of selection is based on looks/colour.

We hence came up with the creative thought of " Rang Diye Jaye Chenna" - rang se (purity) pehchano

Then came the creative leap of presenting this context as content using a celebrity.

Byomkesh Bakshi is an Indian-Bengali fictional detective created by Sharadindu Bandyopadhyay. Referring to himself as a "truth-seeker" ; Bakshi with his sidekick Ajit) is known for his proficiency with observation, logical reasoning, and forensic science which he uses to solve complicated cases, usually murders. The role in recent years has been most successfully essayed by Anirban Bhattacharya . This has helped him achieve almost cult status in the West Bengal diaspora.

The idea hence came up to create a series of advepisodes ( my term:)) showing Byomkesh solving different crimes using the indelible proof of 'colour' as the proof of purity - a fake vs real Red Diamond , blood vs tomato sauce at a crime scene or even colour draining from a persons face that marks him as the culprit. When asked how ; he answers - 'rang hi hai purity ki pehchaan'

The campaign started with teasers for an upcoming film starring Anirban to create intrigue. It then morphed into a multi media launch consisting of TV ads, social media, outdoor and onground. The campaign has just been launched in end August 2024 and will run through the Durga Puja season as well

Credits

Ganesh Grains : Mr Manish Mimani, Angshuman Ghosh

Agency : Blue Stockings

Monday, April 1, 2024

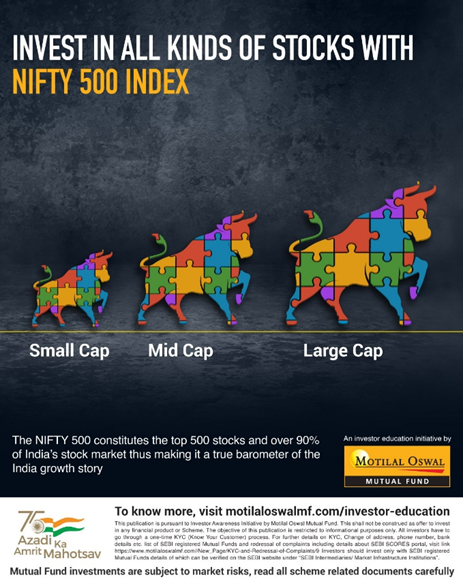

Look beyond the NIFTY 50

For someone entering the equity markets; the NIFTY 50 is the bellweather index to invest in. Thats because it consists of blue chip large caps comprising India's largest stocks.

However; there is another index which is the true Bharat Ka Index. An index that captures the true essence of the Indian stock market with over 90% of its market cap covered( vs 51% of the NIFTY), an index that comprises all 21 sectors ( NIFTY 50 covers only 14) and combines all the stocks of Nifty 50 Index, Nifty Next 50 Index, Nifty Midcap 150 Index, and Nifty Small Cap 250 Index. Globally too indexes like the S&P 500, S&P China 500, Stoxx Europe 500 are a bellweather of the stock market. And what's more ; the NIFTY 500 has outperformed the NIFTY 50 in terms of returns ( 15.6 vs 14.1% CAGR or 36x vs 26x ) as well as lesser volatility ( see details here)

So if you want to participate in the growth story of the Indian stock markets but don't know what stocks to buy but still want to invest; you should look beyond the NIFTY 50 and invest in the NIFTY 500. What's more there exist cost effective Index Funds that help you do this efficiantly

This is the focus of an investor education campaign by Motilal Oswal Mutual Fund. As an equity investing expert, MOAMC 's investor education efforts too go beyond generic messaging on SIPs etc to more specific messaging on how investors can make the most of the stock markets.

The creative idea has been to use the metaphor of another bellweather of the stock markets - the bull.

Have a look at the campaign below which is a combination of TV, print , digital and on ground messaging.

Campaign conceptualised by The Sweet Spot and executed inhouse by the MOAMC Marketing team

TV

PRINT AD

Thursday, November 23, 2023

OUR PROCESS. YOUR SUCCESS.

Motilal Oswal Mutual fund launched in mid 2015 with a range of active-passive and passive ETFs. As ETFs at that time were a new and nascent category; the business decided to move into traditional active funds. However; since the brand was a late entrant into a category with many established brands ( many with bank lineage) it had to act as a quintessential 'challenger brand' to differentiate itself.

The brand rewrote the category communication codes through various points of differentiation

1. The funds had an enviable track record with consistent outperformance across the various funds. Hence a competitive campaign asking consumers - Sirf ek sawaal. Why not Motilal Oswal? ( Agency Cartwheel) See the ads here, here and here.

2. While other funds had debt, commodities, equity, etc etc; Motilal Oswal Mutual Funds were unique due to their FOCUS only on equity funds. An asset class the group had been mastering for over 30 years. Hence if you were thinking about equity; you should consider the expert ( Agency Mullen Lintas). See the ad here

3. The investment team at the fund house ; lead by Raamdeo Agrawal; had created a unique investing PROCESS (QGLP) to identify stocks and had the patience to hold onto them through their growth cycle. This process was articulated in the tagline - BUY RIGHT. SIT TIGHT (created inhouse) and was practiced across all the Motilal Oswal Mutual Fund active portfolios. See the ad here ( Agency Mullen Lintas)

4. The fund house truly believed in its investing philosophy. So much so that the promoters as well as fund house were the largest investors in their own fund ; hence providing conviction and a reason to trust. See the ad here ( 'Owner eats here' idea developed by inhouse, advertising film developed by Mullen Lintas)

The above campaigns met with much success and also helped MOAMC garner assets of Rs 55,000cr + by 2023.

The brand was now in the market for almost a decade. It was time to move from being a challenger to being a mainstream brand. The investing process had also undergone a few tweaks i.e while QGLP was the bedrock of the investing process; there was a greater focus on Hi-Quality and Hi-Growth in portfolio construction. Motilal Oswal believes this focus on PROCESS we believe would lead to investing SUCCESS for investors

The advertising idea ( developed in-house) showed people managing two things with expertise to co-relate to benefiting from Hi-Quality & Hi Growth portfolios.

Motilal Oswal brand assets developed over the past 5 years were also used ( jingle, look n feel etc) for continuity and memorability. Footage was sourced from online sites rather than shooting ( for time, cost and logistical efficiencies).

Have a look at the campaign below

TV Ashton Bands

PRINTEXTENDING THE CORE BRAND IDEA INTO PRODUCT MARKETING

Friday, November 10, 2023

RUNNING WITH THE BULLS

The past 3 years, stock markets have delivered steller returns . This has lead to millions of new/first time investors joining the markets to enjoy ride. Most of these are DIY investors using discount broking platforms. However there is an important criterion they may have overlooked - stock markets are cyclical. They have their ups and downs. When the going is good, stock markets can thrill. But when things turn challenging and volatile; stock markets can also kill!

As Warren Buffet once said : “Only when the tide goes out do you learn who has been swimming naked.”

Motilal Oswal has been a broking form in the Indian stock markets for over 30 years. It has seen the ups and downs of the markets and knows how to navigate them. They provide this expertise in the form of equity investing advice that is most relevant to newbie investors to help them make the most of stock markets - during ups and downs

Using this insight; Motilal Oswal Financial has come out with a campaign urging investors to use MOFSLs solid advice. The creative idea uses the metaphor of the famous 'running with the bulls' event of Pamplona where people from all walks of life want to experience the unique event with consequences that are sometimes exciting and sometimes tragic. The bull ; as you would know; is a metaphor for the stock markets. Hence aptly landing on the proposition : 'Stock markets can thrill. Stock markets can also kill' Make the most of the market ride; with MOFSLs solid advice by your side.

The film uses actual footage ( purchased with broadcast rights) of the Pamplona event to execute the proposition in an authentic and cost effective way.

Have a look.

.png)